Vendor Finance

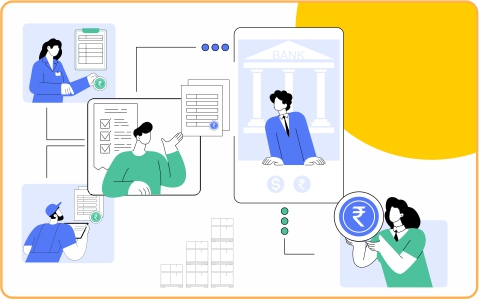

- Our vendor finance platform connects your vendors with multiple Banks & NBFCs on a common portal.

- Your vendors get paid early, enabling them to optimize their working capital.

- You can extend your payment terms and negotiate better rates with them.